Top Fredericksburg bankruptcy attorney Secrets

Should you’re scarcely maintaining together with your bare minimum payments as well as the balances on your accounts preserve rising, then our method might be best for your needs. Why combat a losing struggle versus climbing credit card debt, when our financial debt reduction companies can help?

The information on this Site is not really meant to generate, and receipt or viewing of this info isn't going to represent an attorney-shopper connection.

We don't attribute all providers out there on the market. Any information introduced on this web site, including pricing, is matter to vary all at once. We would like to emphasize that we disclaim all representations and warranties in regards to the accuracy of the data furnished on this site, unless if not explicitly stated in our Conditions of Use. Close

You'll really need to Dwell inside this funds for as much as 5 many years. For the duration of that point the court docket will continuously check your paying out, and will penalize you seriously in case you aren't subsequent the approach. Seem like exciting? To best it off, it will eventually keep in your record for 7 years.

Following your Assembly of your creditors, you will have to take a next personal debt counseling program. This can assist you realize your latest budget and how to handle your debts likely ahead.

Credit history.org is actually a non-earnings service that has a forty five-yr additionally background of excellence and integrity. Best of all, their economical coaching for bankruptcy options is offered at Completely no demand. It's vital that you understand how Credit rating.

LAWPOINTS™ evaluate the general completeness of a Lawyer's profile. A lot more total profiles are ranked greater and help visitors pick out the appropriate attorney quicker.

Frequently you need to exhaust all your options ahead of taking the drastic move of declaring bankruptcy.

For those who're thinking of submitting for bankruptcy, you're not by itself. Annually, many thousands of individuals file for bankruptcy thanks to their too much to handle personal debt.

Having said that, some debts, like college student financial loans and taxes, will continue being. You'll find rigorous specifications for who qualifies for this sort of bankruptcy. And it'll remain on your file for a decade, which pop over to this site may affect your power to get a house, receive a vehicle, or maybe receive a work.

Your browser isn’t supported anymore. Update it learn the facts here now to get the greatest YouTube expertise and our hottest attributes. Find out more

Bankruptcy alternatives is that there are various alternatives readily available for people going through economic hardship. These choices, including financial debt settlement, financial debt consolidation loans, credit history counseling, and personal debt management strategies, give paths recommended you read to manage and cut down credit card debt with no resorting to bankruptcy.

SuperMoney hasn't been around providing a number of the referral platforms we evaluated and so there's not just as much client feedback still. This can be a great way to gather information about own loans you might be suitable for, however , you'll still have to finish your application right With all the lender you decide on.

There might be upfront service fees, early payoff penalties, and various expenses which you might not hope. Before you make a offer, ensure you’ve see this here go through each of the stipulations about service fees and prices. Acceptance Time It will take everything amongst a few days and some months prior to deciding to will know if your software has been approved. This is a thing that is dependent upon the financial look these up debt consolidation services And exactly how it’s run by its owners. Pros and Cons of Personal debt Consolidation As is the case with any debt, personal debt consolidation has equally positives and negatives. Here are some you must think about:

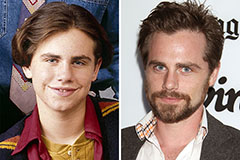

Rider Strong Then & Now!

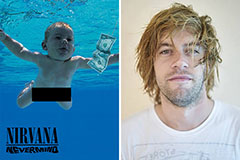

Rider Strong Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!